On Wednesday 27th October, all eyes will be on Chancellor Rishi Sunak, as he delivers his Autumn Budget. However, in an unusual move HM Treasury has released a number of funding announcements in advance of The Budget Speech.

Critics have stated that the announcements are simply a ‘political PR exercise’, designed to soften the blow of what the Government has planned for the taxpayer in the coming months and years. We all agree that additional long-term tax rises are inevitable, but the extent are yet to be fully determined.

The tax team at WHA will provide a full review of all of the announcements for you to review once the Autumn Budget has been delivered, but in the meantime, we wanted to highlight what has been revealed thus far.

- Transport: The Government has announced that England’s city regions will receive £6.9 billion to spend on train, bus, tram and cycle projects. This includes a budget for West Yorkshire, Greater Manchester and West Midlands.

- Health: NHS England will receive £5.9 billion to tackle the huge backlog of people waiting for tests and scans due to the COVID-19 pandemic. That covers £2.3 billion for diagnostic tests including clinics in shopping centres conducting scans, £2.1 billion to improve IT infrastructure and £1.5 billion on beds, equipment and new surgical hubs.

- National Living Wage: Chancellor Sunak himself has already announced a rise in the National Living Wage from £8.91p per hour to £9.50p per hour. This will be effective from 1 April 2022, and is a 6.6% increase in the minimum wage for those aged 23 years and over.

- Housing: HM Treasury is going to allocate £1.8 billion for building, which equates to approximately 160,000 new homes on derelict or unused land.

- Research and Business: Business Grants worth £1.4 billion will be given to ‘internationally mobile’ companies to invest in UK infrastructure.

- Education and Investment in Skills: £2.6 billion will be spent on creating 30,000 new school places for children with special educational needs and disabilities.

- Families: The Government has announced £500m to support parents and children in England.

Last Thursday, the Government also divulged the latest Public Sector Financial data which provided a mixed set of results.

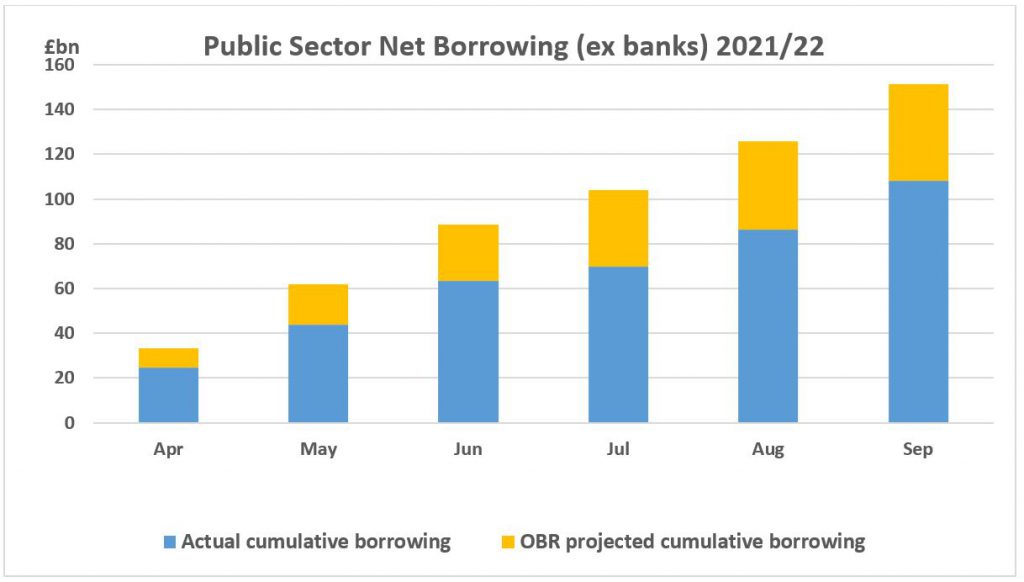

The good news is that the data showed that in the first half of 2021/22 HM Treasury had borrowed £43.4 billion less than the Office for Budget Responsibility had projected at the time of the March Budget.

The bad news is that the reduced borrowing still amounted to over £108 billion. Nevertheless, it looks unlikely that any major tax increases will be revealed this week. Chancellor Sunak has already introduced £42 billion of tax rises this year — encompassing corporation tax, NIC’s and dividend tax — which are yet to come into force.

Source: Office for National Statistics, September 2021

Source: Office for National Statistics, September 2021

What else could be announced in the Autumn 2021 Budget?

- The second report from the Office for Tax Simplification relating to Capital Gains Tax (CGT) arrived after the March 2021 Budget, but could potentially be put into action at this Budget. Persistent rumours suggest that CGT rates may be more aligned with income tax rates.

- Pension tax relief is still an unresolved subject for this Government. HM Treasury have still not addressed the issues around net pay arrangements and low earners, on which it consulted on during 2020.

- The Office for Tax Simplification report on inheritance tax has to date yielded no response beyond a promise — so far unrealised — to simplify application paperwork from the start of 2022.

So far, we have only been given glimpses of headline points, data samples and speculative musings. We will have to wait to see the final announcements in the Budget Speech tomorrow. As always, the devil is in the detail, and the WHA specialist tax team will analyse and outline these for you in our detailed budget summary.