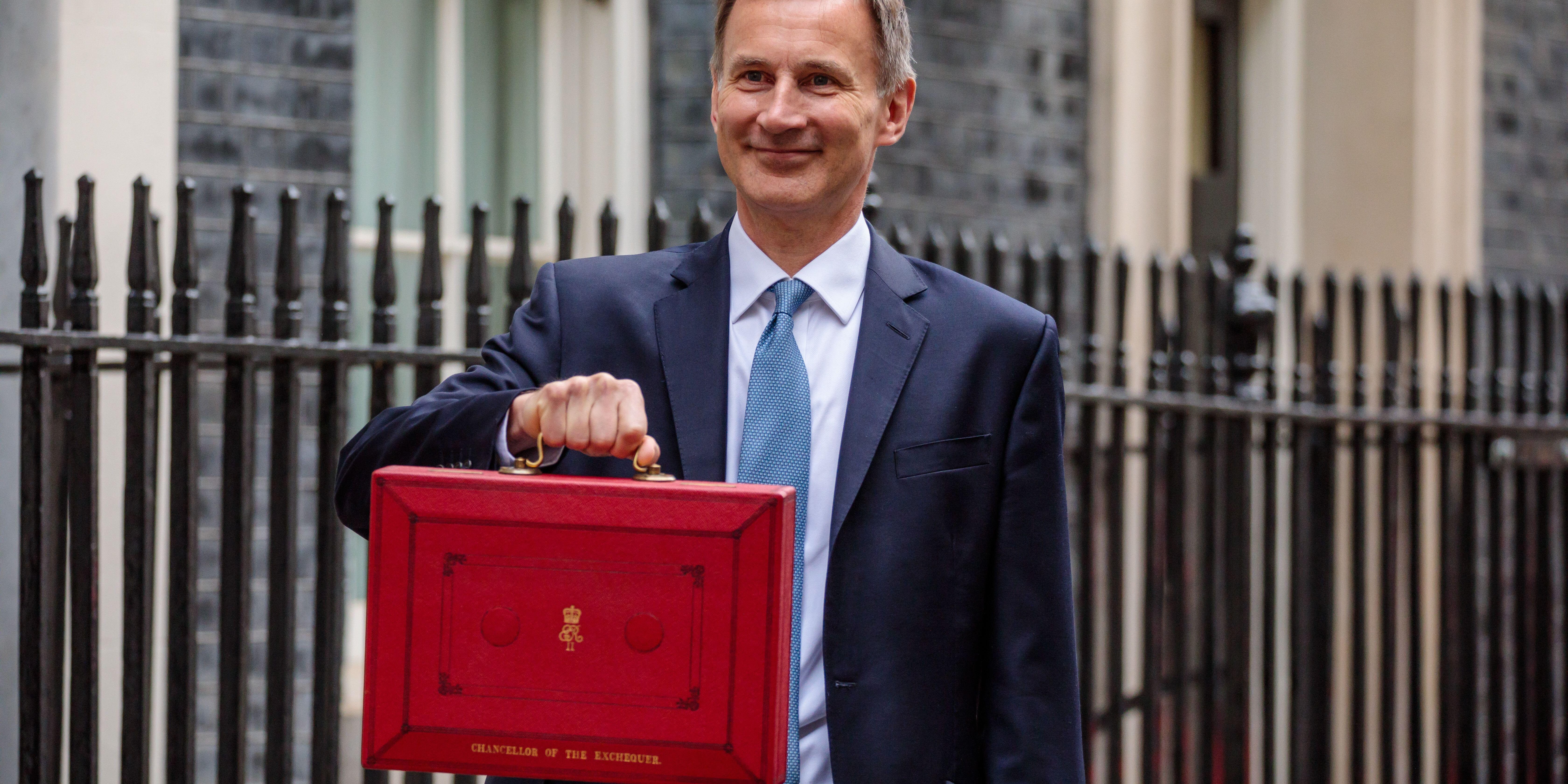

Under the possibility of a potential election date next year, Chancellor Jeremy Hunt delivered his Autumn Statement, a key note achievement of which was the continuing falling rate of inflation based on the latest forecasts from the Office for Budget Responsibility. Against the background of a seemingly recovering UK economy, the Chancellor delivered a “no risk measures” package of fiscal strategies remaining focussed on economic growth.

Amongst the headline key announcements was support extended to small businesses; notable of which was the Government’s decision to extend the business rates relief beyond next spring. This means that for 2023/24 there is a 75% business rates relief for eligible retail, hospitality and leisure businesses of up to £110,000 per business.

Another possible piece of good news for companies was Chancellor Hunt’s decision to make permanent the “full expensing” option for businesses. This equates that for every £1 that a business invests in IT, machinery and equipment, they can claim back 25p in corporation tax. Companies can do this in one go as opposed to having to offset the cost against corporation tax over a longer period, which may provide many with some financial reprieve throughout the fiscal year.

The Chancellor also announced the combination of existing Research & Development expenditure credit and SME schemes in order to reduce the rate at which loss-making technology companies are taxed, which will bring it down from 25% to 19%. Jeremy Hunt has also lowered the threshold for extra support for Research & Development intensive loss-making SMEs to 30%. The Chancellor estimated that this policy will now benefit a further 5,000 SMEs.

Focussing on general tax-payers, Jeremy Hunt outlined Class 2 National Insurance abolishment for self-employed people and a reduction in National Insurance rates for those in employment by 2% (down from 12% to 10% threshold) due to be effective from January next year.

The Chancellor outlined changes to the welfare system, inclusive of support packages for renters and those on some types of benefits seeing increases. A fresh mandatory work placement scheme for those unemployed for 18-months may hopefully introduce more skilled workers to businesses. An important aspect to note is that the Government has decided to honour the triple lock, with the State Pension rising by 8.5% as of April 2024. These support mechanisms will hopefully offer vital breathing space to those most struggling with the cost-of-living crisis.

However, with any budget announcement, the devil is in the detail and what lurks behind the headline announcements can often impact businesses and individuals just as importantly. Therefore, for a comprehensive outline, please review the WHA Autumn 2023 Statement summary — accessible by clicking the image below:

As always, the WHA Team are on hand to help you with any queries that you might have. Please feel free to contact us on 020 8878 8383 or via email on info@whitehartassociates.com.